Buying Property from an NRI: Legal Rules You Must Know

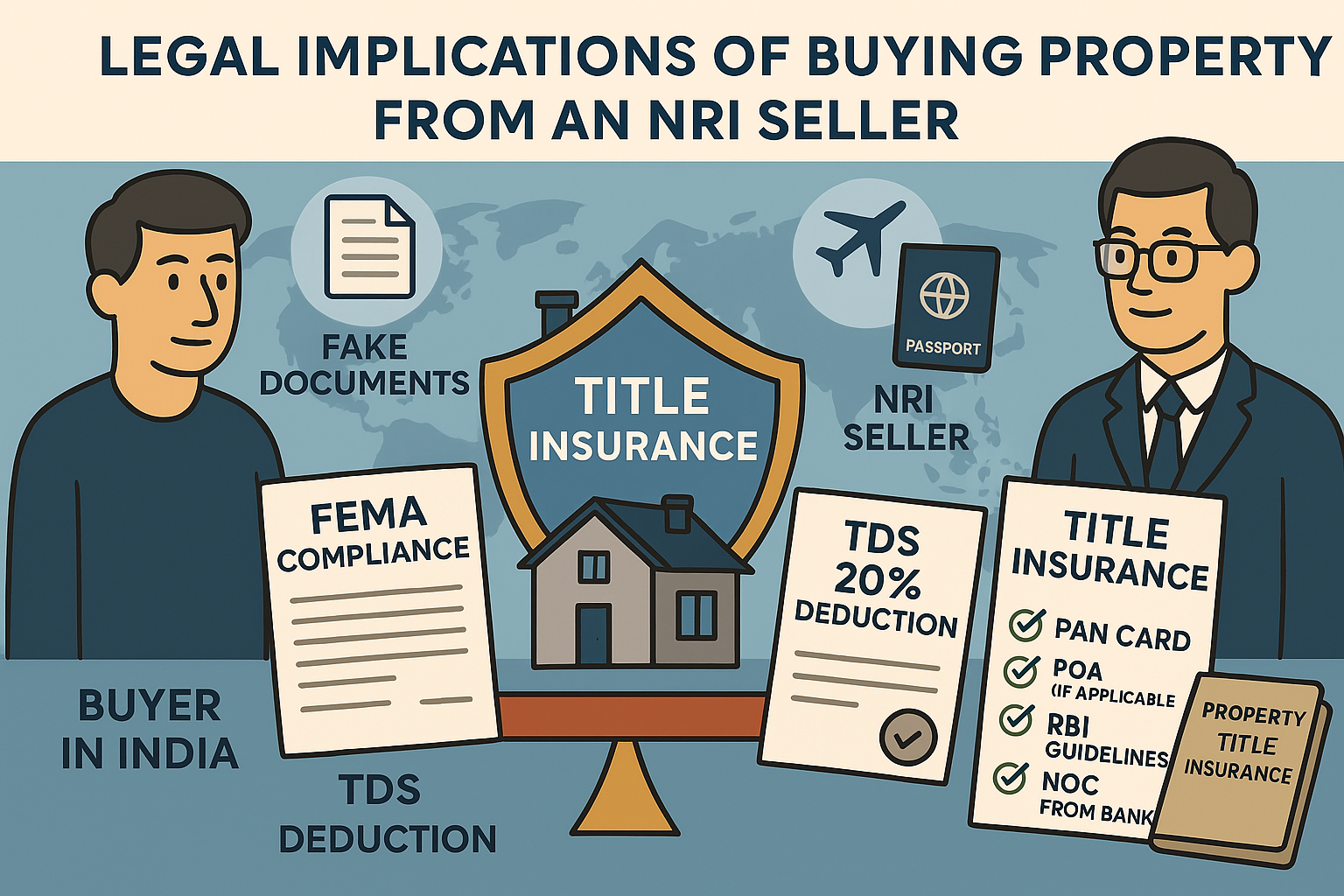

Buying property from a Non-Resident Indian (NRI) requires compliance with FEMA and Income Tax laws. Payments must be made through banking channels to the seller’s NRO account—cash or foreign currency is not allowed. Under Section 195, buyers must deduct TDS at 14.95% on the full sale value and file Form 27Q within 30 days. If the NRI provides a lower deduction certificate, TDS can be reduced. Key documents include the registered sale deed, PAN, passport, EC, NOCs, and Power of Attorney if the seller is abroad. Buyers must also file Form 15CA and obtain Form 15CB from a Chartered Accountant before remitting funds. Always consult a lawyer and CA to ensure smooth compliance and avoid penalties.

Search

Categories

- Lakshadweep

- Delhi

- Puducherry

- PROPIINN

- Arunchal Pradesh

- Assam

- Bihar

- Chhattisgarh

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jharkhand

- Karnataka

- Kerala

- Maharashtra

- Madhya Pradesh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Tripura

- Telangana | Andhra pradesh

- Pulse

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Andaman and Nicobar Islands

- Chandigarh

- Dadra and Nagar Haveli and Daman and Diu

- Jammu and Kashmir

- Ladakh

Read More

Pure Water. Pure Peace. – NexMates Water Purifier Services

Clean water isn’t a luxury—it’s a daily need. Whether you're installing a new...

Finding the Right Electronics Service Provider Through NexMates

Whether it's a broken smartphone, a faulty laptop, or a malfunctioning home appliance, finding...

Trust Issues in Real Estate? Let PropMates Be Your Proof

In real estate, trust is everything.But what happens when people doubt your experience? Or...

Affordable Housing Push in Mysuru: 100 Units Launched in Vijayanagar at ₹25–35 Lakh

April 2025 | Mysuru — In a boost to affordable urban housing in Karnataka’s cultural...

You’re More Than Just Another Agent – Let PropMates Prove It

The market is flooded with agents.But you're not "just another agent" — you're someone who...