Buying Property from an NRI: Legal Rules You Must Know

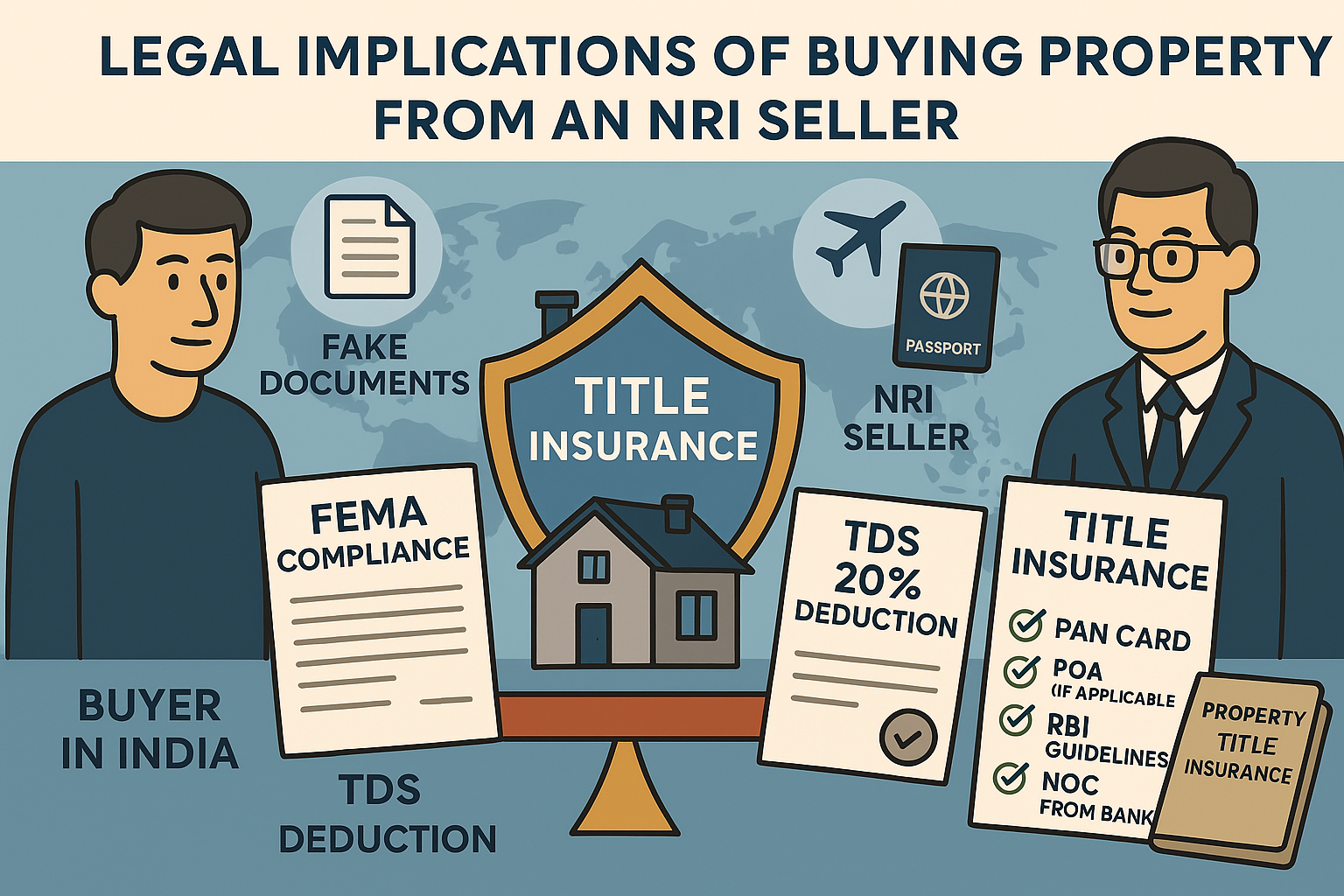

Buying property from a Non-Resident Indian (NRI) requires compliance with FEMA and Income Tax laws. Payments must be made through banking channels to the seller’s NRO account—cash or foreign currency is not allowed. Under Section 195, buyers must deduct TDS at 14.95% on the full sale value and file Form 27Q within 30 days. If the NRI provides a lower deduction certificate, TDS can be reduced. Key documents include the registered sale deed, PAN, passport, EC, NOCs, and Power of Attorney if the seller is abroad. Buyers must also file Form 15CA and obtain Form 15CB from a Chartered Accountant before remitting funds. Always consult a lawyer and CA to ensure smooth compliance and avoid penalties.

Search

Categories

- Lakshadweep

- Delhi

- Puducherry

- PROPIINN

- Arunchal Pradesh

- Assam

- Bihar

- Chhattisgarh

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jharkhand

- Karnataka

- Kerala

- Maharashtra

- Madhya Pradesh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Tripura

- Telangana | Andhra pradesh

- Pulse

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Andaman and Nicobar Islands

- Chandigarh

- Dadra and Nagar Haveli and Daman and Diu

- Jammu and Kashmir

- Ladakh

Read More

Move-In Bathroom Cleaning – Start Fresh, Live Clean

Moving into a new home? Don’t step into someone else’s mess.NexMates' Move-In...

Service with a Smile – Bulk Servers by NexMates

Planning a wedding, corporate event, or large gathering? NexMates provides well-trained servers...

Commercial Property Loans: Eligibility and Benefits

Commercial property loans are designed to provide financing solutions for businesses and...

📸 "Your Photos Sell the First Visit — Make Them Count"

Before they message you, they judge your listing through a screen.

Your visuals aren’t...

Doing Everything Right but Still Losing Clients? It’s Time to Get Verified

You respond quickly.You know the market.You guide clients with honesty.

Still... they choose...