Understanding FAR, FSI & Building Norms Legally

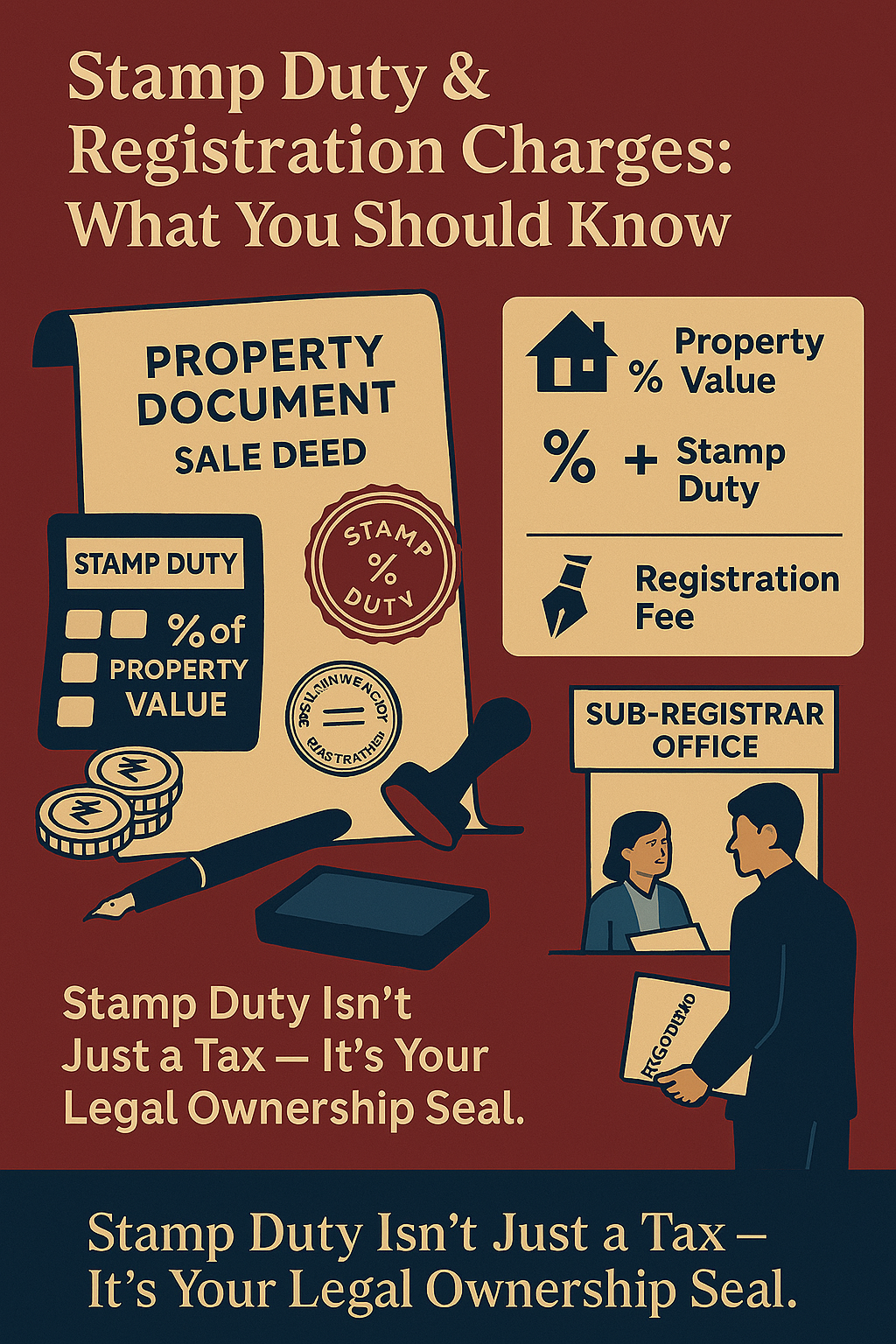

When buying property in India, two charges are non-negotiable: Stamp Duty and Registration Fees. They’re not just costs—they’re what make your ownership legally valid.

What Is Stamp Duty?

A state-imposed tax on property transactions

-

Paid to authenticate the sale agreement or deed

-

Without it, your document isn’t legally admissible in court

-

Governed by the Indian Stamp Act, 1899 and state-specific laws

How It’s Calculated:

Based on property value (circle rate or agreement value—whichever is higher)

-

Varies by state, location, property type, and buyer category

-

Typically ranges from 3% to 8% of the property value

-

Some states offer concessions for women buyers or joint ownership

What Are Registration Charges?

A fee paid to the Sub-Registrar’s Office to officially record the sale

-

Confirms the legal transfer of ownership

-

Usually 1% of the property value, or a fixed amount for high-value properties

-

Governed by the Registration Act, 1908

How to Pay:

Online via state portals or SHCIL (e-stamping)

-

Offline through stamp paper, franking, or Sub-Registrar’s Office

-

Payment proof is essential for registration

- Lakshadweep

- Delhi

- Puducherry

- PROPIINN

- Arunchal Pradesh

- Assam

- Bihar

- Chhattisgarh

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jharkhand

- Karnataka

- Kerala

- Maharashtra

- Madhya Pradesh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Tripura

- Telangana | Andhra pradesh

- Pulse

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Andaman and Nicobar Islands

- Chandigarh

- Dadra and Nagar Haveli and Daman and Diu

- Jammu and Kashmir

- Ladakh